Viagra gibt es mittlerweile nicht nur als Original, sondern auch in Form von Generika. Diese enthalten denselben Wirkstoff Sildenafil. Patienten suchen deshalb nach viagra generika schweiz, um ein günstigeres Präparat zu finden. Unterschiede bestehen oft nur in Verpackung und Preis.

Taxjustice.net

NARRATIVE REPORT ON IRELAND

Part 1: NarratIVE rEPOrt

How Ireland became an offshore financial centre

Overview and background

Ireland is ranked 37th in the 2015 Financial Secrecy index, based

Chart 1 - How Secretive? 40

on a very low secrecy score of 40, one of the lowest in our index,

combined with a weighting of just over two percent of the global market for offshore financial services. Yet despite Ireland's low

ranking we have chosen to probe it in detail because offshore financial centres are a political and economic phenomenon that

goes far beyond secrecy, and Ireland makes a remarkable case study.

Secrecy was never a central part of Ireland's ‘offshore' offering. Instead, its offshore financial centre is based on two other

key elements. The first, dating from 1956, is a regime of low corporate tax rates, loopholes and laxity designed to encourage

transnational businesses to relocate – often only on paper – to Ireland. The second big development has been the Dublin-based

International Financial Services Centre (IFSC), a Wild-West, deregulated financial zone set up in 1987 under the "voraciously

Exceptionally secretive

corrupt" Irish politician Charles Haughey: the IFSC has striven in particular to host risky international ‘shadow banking' activitya and it has posed – and continues to pose – grave threats to financial stability.

Chart 2 - How Big?

Ireland over half of the world's top 50 banks and half of the top 20 insurance companies; in July 2013 it nearly 14,000 funds (of which 6,000 were Irish-domiciled) administering an estimated €3.7 trillion: up from $840 billion a decade earlier. The Irish Stock Exchange hosts about a quarter of international bonds: Ireland is the domicile for around 50 percent of European ETF assets. In 2014 total IFSC foreign investment in liabilities was equivalent to around 15 times Ireland's Gross National Product (GNP;) as this report explains, many toxic developments in ‘subprime' markets that triggered the global financial crisis from 2008 can trace their lineage back to Ireland.

What is a tax haven or

Ireland hosts a of tax secrecy jurisdiction?

Ireland accounts for slightly over 2.3 per cent of the

haven deniers: as this report makes

global market for offshore financial services, making

clear, it is one of the world's most

it a large player compared with other secrecy

is a bit of a misnomer:

important tax havens or offshore these places aren't just

financial centres.

about tax. From political

The ranking is based on a combination of its

economy perspective, they

secrecy score and scale weighting.

Contrary to popular mythology,

offer escape routes to

Ireland's famous and sudden "Celtic

read more

financial players elsewhere

Tiger" economic boom from the early ("offshore"), helping them

1990s was driven not by Ireland's

avoid taxes, or disclosure,

corporate tax regime, but by other or financial regulation, or

Tax Justice Network 2015 - 23.9.2015

whatever other ‘burdens' of society they don't like. Read

If you have any feedback or comments on this

report, please contact us at [email protected]

factors, as this report explains. It was followed

In short, the tax haven strategy that began in

by a spectacular, debt-laden bust from 2008

1956 is now nearly six decades old -- and was

onwards, from which Ireland is only now starting

spectacularly unsuccessful for Ireland for most

to emerge. For proper context to this report, it

of that time. Note, too, that Ireland's famous

is important to explode the Celtic Tiger myth in

12.5 percent corporate tax rate was in fact a tax

more detail.

rate increase. What triggered the Celtic Tiger

era above all was Ireland's accession to the

The Celtic Tiger myth

EU single market in 1993 – plus several other factors. There are of course important nuances

The simple popular story is that Ireland used

in this basic story.

its 12.5 percent low corporate tax rate, and tax loopholes, to attract foreign multinational

On one level, this is a fairly straightforward tale

corporations, and built the so-called "Celtic

about corporate taxes, financial deregulation

Tiger" Irish economic boom on the back of

and their local economic impacts. But on

that, helping Ireland the single largest

another level this is an Irish version of a

location outside the US for the declared pre-

phenomenon we've encountered in tax haven

tax profits of U.S. firms. The Irish singer Bono

after secrecy jurisdiction: the state ‘captured'

echoed popular beliefs when he said that

by offshore financial services. Before exploring

Ireland's corporate tax system "brought our

this peculiar story of nepotism and hubris,

country the only prosperity we've known."b

however, it is worth providing more context for the Celtic Tiger.

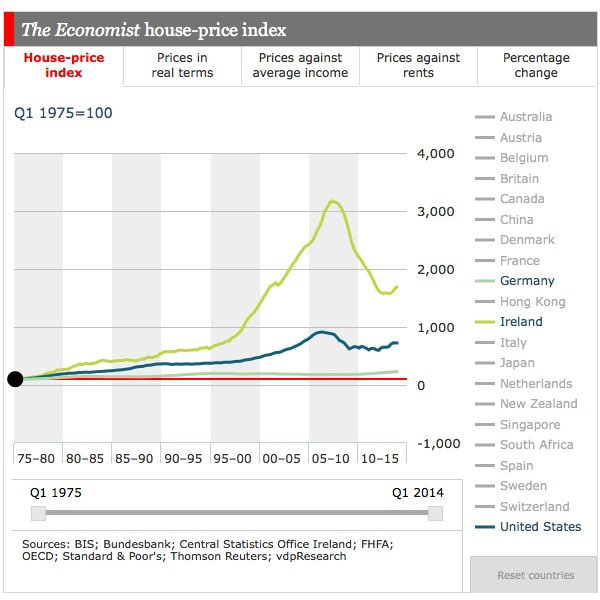

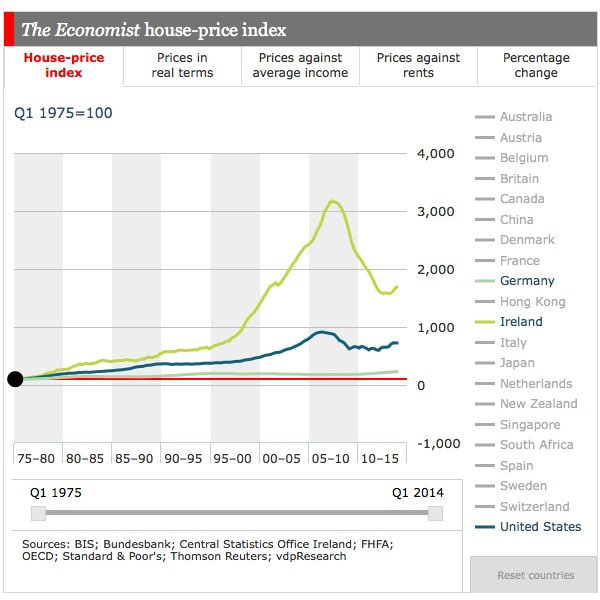

The next graph helps illustrate why the popular story is quite wrong.

Chart 1: Ireland's GNP per capita, as a share of

European GNP per capita, 1955-2013

Source, Fools' Gold blog, March

10, 2015, and associated sources and links. Graph

created by John Christensen and Nicholas Shaxson.

what was most likely the boom's biggest driver: soaring property prices.

"it is difficult to avoid the conclusion that Irish economic performance has been the least impressive in Western Europe, perhaps in all of Europe, in the twentieth century ()."

The take-off that followed almost as soon as he had published those words was rocket-fired. During the spectacular upswing phase, most of what was written about this episode was uncritical, and often gushing: "an economy to be rather than examined," as one account put it. The describes the attitude:

The new government believed it had discovered a quicker-acting formula for wealth creation: tax cuts to stimulate consumption, property to replace manufacturing as the source of wealth, Dublin to become a tax haven for businesses seeking to avoid the more rigorous regimes of London and New York.

The fact that this looks so similar to our first

As mentioned, it was EU single market accession

graph in scale and timing is no coincidence: this

that was the big factor. But there were of course

was, once again, largely the result of Ireland's

several other crucial ingredients. One was the

accession to the EU single market, which

fact that Ireland had a skilled (and, crucially,

massively boosted housing finance, creating

English-speaking) and educated workforce –

an enormous new pool of available wholesale

many educated by the UK and other countries

funding with exchange-rate risks removede.

during earlier periods of mass Irish emigration – plus membership of the Euro currency from

Irish people only understood how ephemeral a

1999, not to mention a worldwide boom in

lot of this ‘growth' was when crisis hit.

global FDI flows at the time.

It is true that the tax offering did help attract

Inward FDI flows responded massively to all

large amounts of investment, particularly from

these factors: rising from 2.2% of GDP in 1990

U.S. multinationals – and European membership

to an astonishing 49.2% in 2000c. Boosting the

helped keep Ireland off tax haven blacklists that

Irish economy further, European agricultural

apply to classic tax havens such as Cayman and

spending on the country rose from just €500m

Bermuda; a broad network of with

in 1980 to €2bn annually on average from

other jurisdictions complement this.

1990-2010.d Yet the next graph that illustrates

but the story does not end there. The FDI

the European Economic Community (EEC)

benefits to Ireland may have been offset by

it suffered a setback when it was told that

the scale of the tax giveaway involved, and

these tax measures were discriminatory. The

these benefits also have accrued to a relatively

EEC allowed Ireland plenty of time to adapt,

small segment of Irish societyf. What is more,

however, and it responded by replacing the

Ireland has triggered ‘beggar my neighbour'

differential tax system with a single, across-the-

competition from other nations, meaning it has

board tax rate of 10 percent to apply without

to constantly offer new and larger subsidies to

discrimination to all industrial sectors.

mobile capital, just to keep upg.

Implementation of this single rate was delayed

It's also always important to stress that what

until 1981, however, and other sectors such

we've described in this section are simply the

as tourism, facing corporate tax rates of 40

costs and benefits to Ireland: the corporate

percent, began to lobby hard to obtain the same

tax haven strategy (and the financial centre

low tax rate. Finally, in 1997 it was announced

strategy, below) have transmitted tremendous

that Ireland would from 2003 introduce a 12.5

harms onto other countries, notably the U.S.

percent tax rate and expand its application to

which has seen Ireland help facilitate a massive

all trading companies, with non-trading income

transfer of wealth from ordinary taxpayers to

taxed at 25%. This happened over a decade

mostly wealthy shareholders.)

after the Celtic Tiger awoke.

The corporate tax haven strategy, in detail

Tax loopholes and transfer pricing

The Irish corporate tax haven strategy

Ireland's 12.5 percent corporation tax rate is

in 1956 with the Export Profits Tax Relief (EPTR) which completely exempted

Box: Apple, Facebook, Google and the Double

manufactured export goods from corporate

income and profits tax. This was pushed through by John Costello, the Irish Taoiseach (head of

The "Double Irish" scheme relied on two Irish-

incorporated companies: the first, taxable in Ireland,

government) in October 1956, who failed even

collects profits (say, from operations in Europe) but

to discuss the measure with other members of

wipes them out by paying royalties to a second Irish-

the government, and in the face of objections

incorporated company tax resident in another tax

from the Irish Revenue - relying instead (on

haven like Bermuda or Cayman, which won't tax them.

advice from his son-in law Alexis Fitzgerald and

In 2014 the Irish government, under international

other personal advisers. The ‘captured state,'

pressure, said it would phase out the Double Irish;

with its incestuous links among political and

new schemes are already in development.

economic insiders and absence of democratic debate, was evident from the outset.

A U.S. Senate investigation in 2013 found that the

U.S. technology firm Apple had used the Double Irish

The tax exemptions were expanded in the late

in what U.S. Senator Carl Levin called the "holy grail

1950s – not least with the Free Zone around

of tax avoidance. . magically, it's neither her nor

Shannon airport – the world's first Free Trade

there". These Irish-based entities were not taxable

zone – and the system really took off in the

anywhere, y no tax on the lion's

1970s when the Industrial Development

share of for Tax Justice

Authority (IDA) started aggressively marketing

in the U.S. that Apple would owe

Ireland's tax system internationally, under

nearly if it hadn't stashed its profits off

slogans such as ‘no tax' and ‘double your after-tax profits' (.)

An Irish subsidiary at the heart of Facebook's tax

affairs funneled profits of €1.75 billion in 2012 to a

While these antics attracted some investment

pre-tax loss of €626,000 by paying mighty ‘expenses'

and profit-shuffling to Ireland, the graph above

to another Irish Facebook subsidiary tax resident

shows that they failed to deliver economy-wide

in Cayman. Similarly, Google escaped $2 billion a

benefits And, as Ireland negotiated entry into

year in taxes using a "Double Irish" scheme via the

Netherlands and Bermuda.

well known, but less has been written about

Phil Burwell, said he had "no responsibility for

its role in providing prolific tax loopholes: a

the nominee directors or activities of the firms

far more important offering for many large

after they are incorporated."

The Irish Financial Services Centre (IFSC)

The key for multinationals is to make sure

The second main leg in Ireland's ‘offshore'

that the lion's share of profits can escape that

offer came with the birth of the Irish Financial

12.5 percent tax rate by being shifted to a tax

Services Centre.

haven (or nowhere – see the Box) where they get taxed lightly or not at all. Ireland makes this particularly easy to do, not only because

In the late 1970s a group of Irish officials, with

of the general laxity of its tax administration,

the help of Wall Street offshore lawyer

but more specifically via

sought to set up an offshore banking

tricks. Astonishingly, until 2010 Ireland had no

centre modelled on Bermuda. The Irish Central

meaningful transfer pricing legislation, allowing

Bank rejected it, saying that it "smacked of a

something of a Wild West free-for-all, which has

banana republic.)

since only been tightened up a little.h This lax regime produced famous wheezes such as the

Yet within a decade the concept had been

"Double Irish" tax scheme operated by the U.S.

revived, and pushed aggressively through by a

tech firms Facebook, Apple and Google (see

tiny group of insiders with very little democratic

The biggest early driver of the IFSC project was the (now billionaire) stockbroker , formerly of Citibank and

Pricewaterhousecoopers,

who first the idea to a few key individuals in a meeting in Kitty O'Shea's pub in Dublin. In 1985 he formally proposed the idea of a financial centre in Dublin to the government. Desmond's stockbroking firm part-financed the first full-scale feasibility study by PWC, and he also owned some

box) which have, as this graphic illustrates, led

of the original buildings that would become

to extremely low effective tax rates in Ireland

designated to the IFSC project. He then got

for US multinationalsi.

together with stockbroker Michael Buckley, later to become Chief Executive of Allied Irish

Shady shell companies

Bank, to the relevant section of the manifesto for the dominant political party,

Beyond these tax-structuring activities, Ireland

Fianna Fáil, during the 1987 election campaign,

– like many offshore jurisdictions – has also

with a promise of 7,500 full-time jobs within five

been happy to serve as an ask-no-questions

years. Fianna Fáil was led by Desmond's friend,

incorporation centre for shady businesses.

the politician Charles Haughey (see box), and

As the Irish Times in June 2013, one

although the document asserted that

Dublin-based company incorporation business

it was "not oriented in any way towards the

alone had set up some 2,000 shell companies,

creation of a tax haven," they all knew that the

some of which have been found to have been

truth would be the opposite.

involved in large-scale criminal activities around the world. The man behind the agency,

"‘Finance', in the current era,

Haughey was returned as Taoiseach (head of

is not just a sector of the

government) in March 1987, and within two months the government had chosen

economy; it is at the core of a

in Dublin to host the IFSC.

new social settlement in which

Padraig O'hUiginn, Haughey's super-fixer

the fabric of our society and

The IFSC project was bulldozered into place

economy has been reworked."

above all by a fixer named Padraig O'hUiginn, Haughey's right hand man. O'hUiginn

compete with nearby banking centres such

"tremendously strong personality" and

as Luxembourg and the Channel Islands,

"unique levels of say-so" in politics: Haughey

including a tax rate of 10 percent for licensed

reportedly considered him to be "as wise

companies. A raft of laws and rules, notable

as old sin himself." A leading employer said

for their laxity, were crafted to attract global

that O'hUiginn ‘could walk on water;' and when O'hUiginn spoke about "my 11 years working under three Taoisigh [Taoiseachs],"

Charles Haughey: corrupt offshore Taoiseach

businessman Tony O'Reilly that "three

The " Charles Haughey was

Taoisigh worked under O'hUiginn."

Irish Taoiseach (prime minister) for most of the

Allied Irish Bank's Buckley, O'hUiginn had

time between 1979 and 1992, roughly at the same

Haughey's authority to "persuade, bully .

time as Margaret Thatcher in the UK.

whatever needed to be done to get the other government departments on board." An Irish

Haughey owned a large yacht, racehorses, the

analyst, via email to TJN, said O'Huiginn's

private island of Inishvickillane, and a Georgian

main legacy was "to politicise the civil service

mansion with 250 acres near Dublin – yet few

so no-one critical of government policy was

could understand where this great wealth had

ever promoted. O'Huiginn did his master's

come from. Haughey's personal financial manager,

bidding (Haughey) and twisted all sorts of rules,

Des Traynor, was chairman ,

a Cayman bank which, along with various trusts and shell companies, was a part of an offshore

Padraic White, then head of the Industrial

web that constituted Haughey's personal finances.

An inquiry (the McCracken report) of 1997 into

democratic processes were shunted aside for

corrupt payments to Irish politicians came up

stonewalling from the Cayman Islands and was hampered by the fact that John Furze, the former

"Within the public service, new

MD of Ansbacher Deposits who faced questioning

initiatives tend to develop slowly.

over Haughey's finances, died in Cayman weeks

These are advanced, after much

before a key tribunal appeal in the case. The

consultation, and refined, usually

tribunal eventually found large-scale corrupt

by committees. So before a policy

and suspicious payments to and from Haughey

proposal finally emerges as government

running through secrecy jurisdictions including

policy, it must survive a high degree

Switzerland, Cayman, London and the Isle of Man.

of scrutiny via checks and balances.

Finlan O'Toole described Haughey as

. . In this instance, the composition of

"a self-procliamed patriot whose spiritual home

the IFSC committee made the vital

was in the Cayman Islands' and ‘[a] lover of his

difference. So when O'hUiginn [see box]

country who could treat it like a banana republic.

turned to any departmental secretary

. a man who called for sacrifices from his people

and gently enquired, ‘I presume this is

but was not prepared to sacrifice one tittle of the

possible,' there was no place to hide.j"

trimmings" [pp 127 and 131]

Tax incentives were created for the IFSC to

Haughey's pestilentially complex financial affairs are laid bare .

money management, foreign currency dealing,

In 2006 Depfa, which had a tiny sliver of just

equity and bond dealing, and insurance – and

€2.98 billion in equity bootstrapping nearly

the finance minister was given leeway to allow

€223 billion in gross assets, collapsed when

services "similar to or ancillary to those" – a very

its Irish subsidiary could not get short-term

broad net. The laws were fully in place within

funding. Later, the head of the German financial

just three months of the new government being

regulator Bafin said that the rescue of Hypo

formed, once again highlighting how normal

had "prevented a run on German banks and

processes of scrutiny had been steamrollered.

the collapse of the European finance system." A Bear Stearns holding company, Bear Stearns

The IFSC was marketed aggressively abroad

Ireland Ltd., was similarly leveraged, with a

with a showpiece seminar in the City of London

ratio of one dollar of equity underpinning $119

on St Patrick's Day, 1988. For financial sector

in gross assets. Even so, almost no analyses of

players Dublin had suddenly become, like

this and other episodes involving the likes of

– and in tune with the Irish corporate

Lehman Brothers, AIG and others, investigated

tax system – a Wild West of financial regulatory

the core role Dublin played in the problems that

indulgence. Almost immediately the world's

subsequently emerged.

banks descended on Ireland; by the end of that year fifty banks had applied for licences,

Ireland, it seems, had not been interested in

including Chase Manhattan and Citicorp.,

tackling or even investigating the dangers. The

Commerzbank, Dresdner Bank and ABN.

Irish financial regulator has been quoted as saying

Financial services activity in Ireland exploded,

that it had no responsibility for such entities: its

notwithstanding the somewhat

remit extended only to banks headquartered

taken by the Fine Gael government of

in Ireland. If the relevant documents were

1994-1997 towards what was seen as a Fianna

provided to the regulator by 3 p.m., Stewart

Fail project. Ireland, as one

a fund would be authorised by start of business the next day (a prospectus can run to

"began to see itself as an outpost of

200 or more pages; it can hardly be assessed

American (or Anglo-American) free-

between 3 pm and the close of business at 5

market values on the far edge of a

pm.!) Even years after the global financial crisis,

continent where various brands of

Ireland's regulator says that financial-vehicle

social democracy were still the political

corporations such as those that helped bring

Depfa down are not regulated: its role, it says, is to regulate firms but not specific financial

Perhaps the only detailed academic examination

products, and in 2013 that only

of Ireland's regulatory laxity comes from

two employees at the Central Bank oversee the

entire trillion-dollar industry. Again, this kind of

The IFSC, he reveals, formed a core element in

turning of a blind eye is a classic and deliberate

the toxic global "shadow banking" system that

led to the global financial crisis. For example, hedge funds would typically be listed in Dublin,

Another financial commentator

managed in London and domiciled in a classic

Ireland as "Germany's Offshore Tart," and noted

tax haven like the Cayman Islands.

to tap funds of ‘various shades of shadiness' from the former Soviet Union:

When the global financial crisis hit, many Dublin-listed structures collapsed. Germany's Sachsen

German banks used to fly their people

Bank, IKB, West LB and Hypo, for instance, all

from Germany to Ireland in order to do

required massive state aid after luxuriating in

deals that were not allowed in Germany.

Dublin's regulatory permissiveness. Hypo Bank

. This is known in the financial world

was bailed out with €102 billion in German

as jurisdictional arbitrage. You and I

state loans and guarantees after it took over

would call it cheating if we were feeling

Ireland-registered Depfa Bank based in Dublin.

charitable and lying if we weren't. . I

have spoken to such people. Usually I

officials often operating in secret, collaborating

can hear the sweat coming off them as

closely with global offshore financial sector

they ask how I got their number and

interests, and frequently leading to corrupt

where did I get my information.

and insider dealing at the expense of the rest of the population. These insiders successfully

According to an article in the Financial Times,

ring-fence the sector against local democratic politics, and intimidate tax authorities and

"The almost total absence of effective

regulators into giving them more or less free

banking regulation would be laughable

had it not been so serious. Irish business and the Fianna Fáil-led government

Jesse Drucker of Bloomberg News

enjoyed a long established, cosy

one of the key insiders:

camaraderie in which peer review or the effective implementation of basic

"Feargal O'Rourke, the scion of a

regulations was impossible. The result

political dynasty who heads the tax

was horrific: the bankruptcy of the

practice at PricewaterhouseCoopers in

entire Irish banking sector involving

Ireland. . He persuaded regulators

bad debts in excess of €70bn – one of

to eliminate a withholding tax on

the biggest financial busts in history."

profits that corporations move out of the country -- while separately advising

Tape recordings released by the Irish

his cousin who was finance minister.

Independent newspaper revealed that when

the government rescued Anglo Irish Bank

He was instrumental in creating an Irish

based on fictitious calculations of the bank's

tax-credit program that subsidizes the

bad debts, the executive said those calculations

research of companies like Intel Corp. -

had been "picked out of my arse;" Anglo Irish's

- another client. . O'Rourke sees no

Chief executive is said to have urged a colleague

conflict in his dual roles representing

to respond to anger in Germany, and elsewhere

private industry and advising the

at the damage spilling over with:

government on issues that benefit his clients.

‘ "Stick the fingers up!" To which his colleague responds with a spirited

In his book Ship of Fools, the Irish commentator

rendition of "Deutschland, Deutschland

Finlan O'Toole talks of "a lethal cocktail of global

über alles". Both men dissolved in

ideology and Irish habits" and, as one reviewer

The "captured state"

"All this has been accompanied by a

This history constantly provides reminders of

culture of corruption so shameless and

how Ireland shows all the symptoms of the

spectacular that it makes Dublin look

‘financially a phenomenon

like Kabul. The former prime minister

we've described in so many of our narrative

Charles Haughey stole €250,000 from a

reports on tax havens and secrecy jurisdictions.

fund set up to pay for a liver transplant

This involves nepotistic and often corrupt links

for one of his closest friends. . as

between business and politics and a deference

O'Toole points out, bribery, tax evasion

to offshore financial services and a society-wide

and false evidence under oath have not

consensus supporting the system.

simply gone unpunished; the very idea of penalising the culprits is viewed by

Since 1956, corporate tax and financial policies

the governing elite as unsporting or

have since 1956 been crafted with little

even unpatriotic."

or no democratic consultation by affected populations, and instead by small groups of

The willingness to brush dirt under the carpet

to support the financial sector, and an equating

indistinguishable.

of these policies with patriotism (sometimes

same deference to Big Finance and

known in Ireland as the ,)

multinational corporations prevails."

contributed to the remarkable regulatory laxity with massive impacts in other nations (as well

Or, as another observer more colourfully

as in Ireland itself) as global financial firms

sought an escape from financial regulation in

"is the Irish state's legal apparatus

whoring for the banks?"

The captured state was evident again at the

Another FT report in December 2013, entitled

height of the financial crisis. Jack Copley of

Irish pace of reform blamed on cronyism,

Warwick University describes one illustrative

highlights how the old ways of the past had

episode for the Fools' Gold blog: Experts

not been expunged, despite the scale of the

from Ireland's National Treasury Management

devastation wrought by the financial crisis,

Agency were brought to government offices on

the ensuing bailout, the public anger, and the

the night of the bailout, only to be

largest electoral mandate for change in the

history of Ireland. As Sinn Féin spokesman

while the Taoiseach, ministers and certain bank

Pearse Doherty put it, "The golden circle still

executives decided to issue a blanket guarantee

exists." The article quoted Donal Donovan of

of bank liabilities.m

the Irish Fiscal Advisory council as saying:

The problem appears to have continued almost

"The bailout treated the sick patient

unabated. A in the Financial Times

but didn't tackle the underlying issues

describes a meeting in 2011:

of political reform, a failure to listen to criticism and a reluctance to look

‘They met under the auspices of the

elsewhere for advice. . These factors

"Clearing House", a secretive group

were at the root cause of the financial

crisis and the previous Irish fiscal crisis

accountants and public servants formed

in the 1980s. Unless we think about

in 1987 to promote Dublin as a financial

this now it could happen again in 15

hub. . The participants thrashed out

years' time".

21 separate taxation and legal incentives sought by the financial industry at the meeting, which took place in room 308

read more

in the prime ministers' offices. .

The lobbying was done in secret behind

closed doors," says Nessa Childers,

an Irish member of the European

parliament, who got minutes of the

Fools' Gold Blog / Naked

meeting using freedom of information

Capitalism, March 10, 2015.

laws last year. "The bankers and hedge

fund industry got virtually everything

they asked for while the public got hit

Prof. Jim Stewart, Trinity College Dublin,

with a number of austerity measures".'

IIIS Discussion Paper No. 420, Jan 2013-

A September 2013 editorial by the Irish

political magazine highlights how

Tax Justice Focus, Vol.

the offshore financial consensus continued to

4 Number 2, 2008. Jim Stewart's article provides

pervade politics thereafter.

a much shorter summary of his subsequent paper.

"Never have two political parties

Eichengrw the single market boosted

paper, September 2011

property prices: "Claims on the Irish banking system

peaked at some 400 per cent of GDP . . this was

Progressive Tax Blog, Feb 23, 2011 (scroll

an exceptionally large, highly leveraged banking

system atop a small island. It grew out of the high

mobility of financial capital within the single market.

Sullivan, Forbes.com, Nov 6, 2013

It reflected [among other things] the freedom with

which Irish banks were permitted to establish

and acquire subsidiaries in other EU countries. It

2000. An uncritical yet informative chapter in

reflected the ease of accessing wholesale funding

the book The Making of the Celtic Tiger: the

given the perception that the exchange risk that

inside story of Ireland's boom economy, by Ray

would have otherwise been associated with making

MacSharry, Padraic White, 2000.

local-currency loans to Irish banks was absent in a

monetary union. It reflected the perception (more

accurately, the misperception) that bank failures, like sovereign defaults, had been rendered a thing of the past."

With thanks to Jim Stewart, Sheila Killian and

Tom McDonnell for their help with this article.

p13, Sheila Killian, submitted to Critical Perspectives in Accounting, 2006. Separatelythis ‘capture' may cause long-term trouble for Irish people. "As a country

grows more and more dependent on one source of revenue, be it mining or aid, the government

a The term "shadow banking" is attributed to the

becomes less and less dependent on, and so

U.S. financier Paul McCulley, who described it as

accountable to the people of the country. Instead,

"the whole alphabet soup of levered up non-bank

it focusses on meeting the needs of the sector or

investment conduits, vehicles, and structures." It

group which is essentially supporting its ability to

generally refers to banking activity that lies outside

remain in power. If this logic can also be applied

the purview of normal banking regulations.

to a relentless singleminded policy of using tax to

b Bono's comment came in response to criticism

attract FDI, the implications for Ireland are obvious

of him for calling for more tax-financed foreign aid

while his band U2 had been benefiting from various

g For example, Liechtenstein plans for

artificial tax-dodging arrangements.

a 12.5% across-the-board corporation tax rate,

c O'Hearn, D. (2000) Globalization, "New Tigers," and

explicitly to match Ireland's. The United Kingdom

the End of the Developmental State? The Case of the

has more recently competing tax

Celtic Tiger. Politics & Society. Vol. 28(1): 67-92 and

Kirby, P. (2010) Celtic Tiger in Distress: Explaining

h PwC the situation as "the absence of

the Weaknesses of the Irish Model.Second Edition.

local regulations and scrutiny prior to the 2010

Basingstoke: Palgrave Macmillan.

Finance Act." The changes in 2010 do not apply to

investors already in Ireland; and they are restricted

Jack Copley, Fools' Gold blog, May 5, 2015

to those profits that are subject to Ireland's 12.5

percent tax rate.

Fools' Gold Blog / Naked

i There has been plenty of myth-making in Ireland

Capitalism, March 2015, and associated sources on

about the corporate tax rate. Studies cited by the

Irish Times and others suggest that the effective tax

e (To be more precise, as Jack Copley of Warwick

rate is close to the headline 12.5 percent rate. But

University , this was a tale of two booms:

this is a fictional result based on a widely derided

first, a real FDI-based boom lasting from the early

result obtained by PWC, theoretical ‘standard firm

1990s to 2001; then a second property-based

with 60 employees which makes ceramic flower

one from 2001-2007.) The U.S. economist Barry

pots and has no exports: it is entirely inapplicable

to transnationals. See , Jim Stewart, IIIS Discussion Paper No. 442, Feb 2014. Though there are various ways to calculate effective tax rates, find rates of just 2.5-4.5 percent.

For some more examples of the Double Irish, see Jesse Drucker's reporting , or his looking at the drug Lexapro, which also used the Double Irish scheme. In 2014 it was announced that the Double Irish is being phased out: to see the kind of thing now replacing it see Leonid Bershidsky, Bloomberg, Oct 15, 2014j , by Ray MacSharry, Padraic White, 2000. k Our "" document explores this ‘capture' as a widespread phenomenon of tax havens and large financial centres.

l One reason for the regulators' laxity was the societal consensus that had built up, buttressed by active intimidation. As one player : "I remember once sitting in a meeting with the management of an Irish bank, who were chortling at the foolishness of the Irish Financial Regulator employee who had asked for details of all the mortgage loans they had made above 85% loan-to-value. Apparently they had called his boss and asked for the details of the warehouse that they were meant to send three lorries of paper files to. This sort of regulator intimidation — of course they could have sent a couple of CDs and I bet today they wish they had done — really did used to go on.)"m Jack Copley, Fools' Gold blog, May 5, 2015

Part 2: IrELaND'S SECrECY SCOrE

TRANSPARENCY OF BENEFICIAL OWNERSHIP – Ireland

Banking Secrecy: Does the jurisdiction have banking secrecy?

Ireland partly curtails banking secrecy

Trust and Foundations Register: Is there a public register of trusts/foundations, or are trusts/

foundations prevented?Ireland partly discloses or prevents trusts and private foundations

Recorded Company Ownership: Does the relevant authority obtain and keep updated details of

the beneficial ownership of companies?

Ireland - Secrecy Score

Ireland partly maintains company ownership details in official records

KEY ASPECTS OF CORPORATE TRANSPARENCY REGULATION – Ireland

Public Company Ownership: Does the relevant authority make details of ownership of companies

available on public record online for free, or for less than US$10/€10?Ireland partly requires company ownership details to be publicly available online

Public Company Accounts: Does the relevant authority require that company accounts are

made available for inspection by anyone for free, or for less than US$10/€10?Ireland requires company accounts to be available on public record only for a fee

Country-by-Country Reporting: Are all companies required to publish country-by-country

financial reports? Ireland partly requires public country-by-country financial reporting by some companies

EFFICIENCY OF TAX AND FINANCIAL REGULATION – Ireland

Fit for Information Exchange: Are resident paying agents required to report to the domestic tax

administration information on payments to non-residents?

partly requires resident paying agents to tell the domestic tax authorities about payments to

non-residents

Efficiency of Tax Administration: Does the tax administration use taxpayer identifiers for

analysing information efficiently, and is there a large taxpayer unit?

Ireland partly uses appropriate tools for efficiently analysing tax related information

Avoids Promoting Tax Evasion: Does the jurisdiction grant unilateral tax credits for foreign tax

payments?Ireland partly avoids promoting tax evasion via a tax credit system

Notes and Sources

Harmful Legal Vehicles: Does the jurisdiction allow cell companies and trusts with flee clauses?

Ireland partly allows harmful legal vehicles

The ranking is based on a combination of its secrecy score and scale weighting to see our full methodology).

INTERNATIONAL STANDARDS AND COOPERATION – Ireland

The secrecy score of 40 per cent for Ireland has been computed by assessing its performance on 15

Anti-Money Laundering: Does the jurisdiction comply with the FATF recommendations?

Key Financial Secrecy Indicators (KFSI), listed on the

Ireland partly complies with international anti-money laundering standards

left. Each KFSI is explained in more det

Automatic Information Exchange: Does the jurisdiction participate fully in multilateral Automatic

Green indicates full compliance on the relevant

Information Exchange via the Common Reporting Standard?

indicator, meaning least secrecy; red indicates non-

Ireland participates fully in Automatic Information Exchange

compliance (most secrecy); and yellow indicates partial compliance.

Bilateral Treaties: Does the jurisdiction have at least 53 bilateral treaties providing for information exchange upon request, or is it part of the European Council/OECD convention?

This paper draws on data sources including

regulatory reports, legislation, regulation and news

As of 31 May, 2015, Ireland had at least 53 bilateral tax information sharing agreements

available as of 31.12.2014 (with the exception of

complying with basic OECD requirements

KFSI 13 for which the cut-off date is 31.05.2015).

International Transparency Commitments: Has the jurisdiction ratified the five most relevant

Full data on Ireland is available here:

international treaties relating to financial transparency?

Ireland has ratified the five most relevant international treaties relating to financial transparency

All background data for all countries can be found on the Financial Secrecy Index website:

International Judicial Cooperation: Does the jurisdiction cooperate with other states on money

laundering and other criminal issues?Ireland cooperates with other states on money laundering and other criminal issues

Source: http://www.taxjustice.net/wp-content/uploads/2015/11/Ireland.pdf

The Extraction of Native Giardia lamblia Actin Through Differential Detergent Treatment Nicholas Barker Stoler Submitted in fulfillment of the Senior Thesis requirement in the Department of Biology, Georgetown University, Washington, D.C., May 2008 NICHOLAS B. STOLER The Extraction of Native Giardia lamblia Actin Through Differential Detergent

N o v e m b e r CONTENTS / SUMARIO 38th International Trophy for Quality / XXXVIII Trofeo Internacional a la Calidad Forty companies have been awarded with the International Trophy for Quality 2010. This Trophy for Quality has been created by Editorial OFICE through the Trade Leaders' Club and is