Viagra gibt es mittlerweile nicht nur als Original, sondern auch in Form von Generika. Diese enthalten denselben Wirkstoff Sildenafil. Patienten suchen deshalb nach viagra generika schweiz, um ein günstigeres Präparat zu finden. Unterschiede bestehen oft nur in Verpackung und Preis.

Supermax.com.my

Cover Rationale

Supermax prides itself in always doing its utmost in its field of

expertise, which is the manufacturing and distribution of a now

world-renowned brand of high quality medical gloves. The theme

"Moving Beyond Boundaries" represents another chapter of keen

commitment and hard work aimed at taking Supermax to the

next level. An intense desire to reach for all of its lofty goals and

beyond continues burn brightly within the management team

and throughout the entire workforce.

At all times, the Group puts into practice its core competencies and expertise for all of its day to day business activities in order toachieve superior performance levels. Since our inception in the year 1987, we have taken a stepwise approach in our commitment to scale greater heights whilst charting a path towards sustainable growth and progress. We hold firm to the belief that the success that we have garnered today is built upon our commitment to going the extra mile. Hereon, we shall constantly move beyond our comfort zone to reap a fruitful harvest of sustained growth and success.

Corporate Profile

Financial Highlights

Five-Years Financial Summary

Corporate Structure

Corporate Information

Board of Directors

Profile of Directors

Executive Chairman's Statement

Corporate Social Responsibility

Audit Committee Report

Corporate Governance Statement

Statement On Risk Management and Internal Control

Financial Statements

List of Properties

Analysis Of Shareholdings

Notice Of Seventeenth Annual General Meeting

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

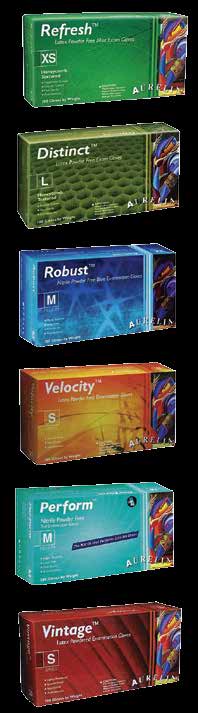

Supermax Corporation Berhad is a leading international

manufacturer, distributor and marketer of high quality medical

gloves. Established in 1987, its founders started a trading

business to distribute latex gloves and eventually ventured into

manufacturing of latex gloves in 1989. Today, the Supermax Group

has nine factories manufacturing various types of latex gloves,

which are exported to over 155 countries around the world, such

as the United States of America, European Union, Middle East,

Asia and South Pacific countries.

The Group has received numerous accolades and awards over

the years, including The Edge Billion Ringgit Club's inaugural

Company of the Year Award in 2010, Export Excellence & Brand

Excellence in the Industry Excellence Awards in 2009 and 2008,

Special Award & 4th placing in the prestigious Deloitte's Top 50

Enterprise Award Malaysia in 2006, Export Excellence & Product

Excellence in the Industry Excellence Awards in 2003, the National

Productivity Council Award in 1999 and Andersen Consulting Top

50 Enterprise in Malaysia in 1998. One of the founders, Dato' Seri

Stanley Thai himself, also won 2 very prestigious awards in 2010,

i.e. Malaysia's Ernst & Young Entrepreneur of The Year Award 2010

and Malaysia's CEO of The Year Award 2010.

Supermax is well recognized for its commitment to deliver quality

products and service to its customers. These accomplishments

testify to the Group's relentless efforts in enhancing productivity in

order to compete in the global market.

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

2013 2012

1,048,151 997,374

After-tax profit

1,369,735 1,254,079

Shareholders' equity

Interim dividend

Net assets per share (in RM)

Earnings per ordinary share of RM0.50 each (in Sen)

* Subject to shareholders' approval at upcoming Annual General Meeting

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Five-Years Financial Summary

NET ASSETS

BASIC EARNINGS PER SHARE

2013 2012 2011 2010 2009

rm'000 rm'000 rm'000 rm'000 rm'000

997,374 1,021,358

Shareholders' equity

Basic earnings per share (sen)

* Based on ordinary share of RM0.50 each.

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

100% Supermax Glove manufacturing Sdn Bhd (218698-T)

100% maxter Glove manufacturing Sdn Bhd (229862-H)

100% Seal polymer Latex products Sdn Bhd (754360-X)

100% Supermax Latex products Sdn Bhd (34197-T)

100% Supermax healthcare incorporated

100% Supermax international Sdn Bhd (551579-X)

98% SuperVision optimax Sdn Bhd (1083853-U)

100% Supermax energy Sdn Bhd (318117-P)

100% maxwell Glove manufacturing Berhad (99472-X)

(Formerly known as Spenser Glove Manufacturing Berhad)

100% Supermax deutschland Gmbh

100% Supermax Global Limited

100% Supermax healthcare Limited

67% Supermax healthcare Canada incorporated

100% White oak Global property Limited

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Board of direCtorS

dato' Seri thai Kim Sim, Stanley

Gong Wooi teik, felix

(Executive Chairman and Group Managing Director)

(Independent Non-Executive Director)

datin Seri tan Bee Geok, Cheryl

Shamsudin @ Samad Bin Kassim

(Group Executive Director)

(Independent Non-Executive Director)

dato' ting heng peng

rashid Bin Bakar

(Independent Non-Executive Director)

(Independent Non-Executive Director)

dato' dr. tan Geok Swee @ tan Chin huat

Gong Wooi teik, felix

Tricor Investor Services Sdn. Bhd. (118401-V)

Chairman, Independent Non-Executive Director

Level 17, The Gardens North Tower

rashid Bin Bakar

Lingkaran Syed Putra

Member, Independent Non-Executive Director

59200 Kuala Lumpur

Tel : 03-2264 3883

Shamsudin @ Samad Bin Kassim

Fax : 03-2282 1886

Member, Independent Non-Executive Director

prinCipaL BanKerS

The Royal Bank of Scotland Berhad (301923-A)

Wong Wai foong (MAICSA 7001358)

HSBC Bank Malaysia Berhad (127776-V)

Joanne toh Joo ann (LS 0008574)

Standard Chartered Bank Malaysia (115793-P)

OCBC Bank (Malaysia) Berhad (295400-W)

Malayan Banking Berhad (3813-K)

Supermax Corporation Berhad

Citibank Berhad (297089-M)

Lot 38, Putra Industrial Park

Bukit Rahman Putra

47000 Sungai Buloh

Baker Tilly Monteiro Heng, AF0117

Selangor Darul Ehsan

Baker Tilly MH Tower

Tel : 03-6145 2328

Level 10, Tower 1, Avenue 5

Fax : 03-6156 2191

Bangsar South City

59200 Kuala Lumpur

Tel : 03-2297 1000

Level 18, The Gardens North Tower

Fax : 03-2282 9980

Lingkaran Syed Putra

StoCK exChanGe LiStinG

59200 Kuala Lumpur

Main Market of Bursa Malaysia Securities Berhad

Tel : 03-2264 8888

Date of Listing : 2 August 2000

Fax : 03-2282 2733

StoCK information

Code No. 7106

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Board Of Directors

1. dato' Seri thai Kim Sim, Stanley

(Executive Chairman and Group Managing Director)

2. datin Seri tan Bee Geok, Cheryl

(Group Executive Director)

3. Shamsudin @ Samad Bin Kassim

(Independent Non-Executive Director)

4. dato' ting heng peng

(Independent Non-Executive Director)

5. dato' dr. tan Geok Swee @ tan Chin huat

(Non-Executive Director)

6. Gong Wooi teik, felix

(Independent Non-Executive Director)

7. rashid Bin Bakar

(Independent Non-Executive Director)

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Profile Of Directors

dato' Seri thai Kim Sim, StanLey

Executive Chairman and Group Managing Director

Aged 53, Malaysian

Appointed on 18 June 2000

Dato' Seri Stanley Thai graduated from the University of Windsor, Ontario,

Canada with a Bachelor of Commerce degree (Hons) in 1982. Dato' Seri Stanley

Thai started his early business training with Mulpha International Berhad before

being appointed as the Chief Executive Officer cum Group Managing Director

of Supermax Corporation Berhad on 18 June 2000. Dato' Seri Stanley Thai

was re-designated as Executive Chairman and Group Managing Director on 27

September 2006. Dato' Seri Stanley Thai is an experienced businessman and has

successfully secured business partnerships with distributions in North American,

Western Europe, Australia, New Zealand, Middle East and Latin American

countries. Dato' Seri Stanley Thai has also been actively involved in overseas

trade promotions and programs organised by the Ministry of International

Trade and Industry (MITI) and is a strong advocate of the "Made in Malaysia

for the World" program of Malaysia External Trade Development Corporation

(MATRADE) since 1983. Dato' Seri sits on the Board of the Malaysian Rubber

Export & Promotion Council (MREPC) since April 2010 and was appointed

Trustee of the Malaysian Rubber Glove Manufacturers Association (MARGMA)

in April 2013.

datin Seri tan Bee GeoK, CheryL

Group Executive Director

Aged 52, Malaysian

Appointed on 18 June 2000

Datin Seri Cheryl Tan graduated with a Bachelor of Commerce degree (Hons) from

University of Windsor, Ontario, Canada. Datin Seri Cheryl Tan was appointed as

an Executive Director in Supermax Corporation Berhad on 18 June 2000 and she

is a member of the Remuneration Committee. Datin Seri Cheryl Tan received her

early business training in credit administration with a local financial institution.

Datin Seri Cheryl Tan heads the finance, operations and administration of the

Supermax Group.

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Profile Of Directors (continued)

dato' tinG henG penG

Independent Non-Executive Director

Aged 53, Malaysian

Appointed on 18 June 2000

Dato' Ting graduated from University of Windsor, Ontario, Canada with a

Bachelor of Commerce degree (Hons) in 1982. Upon graduation, he went to

England where he read law at the University of Essex. Dato' Ting obtained his

Bachelor of Law (Hons) in 1985. Following Dato' Ting's admission as a barrister

by Lincoln's Inn, London in 1986, Dato' Ting came back to Malaysia and was

called to the Malaysian Bar in 1987. Dato' Ting has been in legal practice as

advocate and solicitor in the legal firm of Amin-Tan & Co from October 1987

until May 2007. Since 1 June 2007, Dato' Ting is a Partner of Joseph Ting &

Co. Dato' Ting was appointed to the Board of Supermax Corporation Bhd in June

2000 and is currently Chairman of the Nomination Committee and a member of

the Remuneration Committee. Dato' Ting is also an Independent Non-Executive

Director of D.B.E. Gurney Resources Berhad as well as CSF Group PLC, a

company listed on London Stock Exchange in Alternative Investment Market.

dato' dr. tan GeoK SWee @ tan Chin huat

Aged 63, Malaysian

Appointed on 18 June 2000

Dato' Dr. Tan was appointed as a Non-Executive Director of Supermax

Corporation Berhad on 18 June 2000 and he is a member of the Nomination

Committee. He worked in a public-listed company as senior manager for more

than 10 years before he started his own business in the 1980's. He is the founder

of the renowned Malaysia International Furniture Fair (founded in 1995). He has

good experience in international marketing and promotion. He holds a Hon. PhD

in Business Administration. He is now the Managing Director of TGS Holdings

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Profile Of Directors (continued)

mr GonG Wooi teiK, feLix

Independent Non-Executive Director

Aged 63, Malaysian

Appointed on 28 December 2001

Mr Gong is a Fellow Member of The Institute of Chartered Accountants in

England & Wales, member of the Malaysian Institute of Accountants and

Fellow Member of the Chartered Tax Institute of Malaysia. After qualifying as

a Chartered Accountant in England in 1976, he returned to Malaysia in early

1977 and worked for two of the big 4 International Accounting Firms before

starting his own accounting firm in 1980. He is currently the Managing Partner of

GEP Associates, a member firm of AGN International Ltd, which is a worldwide

Association of Accounting and Consulting Firms. Mr Gong was appointed as an

Independent Non-Executive Director of Supermax Corporation Berhad on 28

December 2001 and he is the Chairman of the Audit Committee. Presently, he is

also Independent and Non-Executive Director of Box Pak (Malaysia) Berhad and

Cheetah Holdings Berhad which are both listed on Bursa Malaysia.

enCiK ShamSudin @ Samad Bin KaSSim

Independent Non-Executive Director

Aged 67, Malaysian

Appointed on 18 July 2002

Encik Samad graduated with a Bachelor's degree in Economics from University

of Malaya in 1970. Subsequently, he obtained Master in Public and International

Affairs from University of Pittsburgh in 1979. He was appointed as an Independent

Non-Executive Director of Supermax Corporation on 18 July 2002 and he is a

member of the Audit Committee and Nomination Committee. He is currently also

a Director of public listed Century Logistics Holdings Berhad, Kinsteel Berhad,

Perwaja Steel Berhad and Multi-Code Electronic Industries (M) Berhad, and sits

on the Boards of 2 non-listed companies, i.e. Ingress Corporation Berhad and

Master Tec Holdings Berhad. He worked in the Ministry of International Trade

and Industry (MITI) for fifteen years from 1985 and was Chief Executive Officer

of SMIDEC since 1 January 2000 and left SMIDEC in retirement on September

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Profile Of Directors (continued)

enCiK raShid Bin BaKar

Independent Non-Executive Director

55, Malaysian

Appointed on 18 July 2002

Encik Rashid holds a Master in Law from UKM and he is a graduate of UiTM

with a Bachelor of Law (Hons). Encik Rashid also has a Diploma in Syariah Law

and Practice from UIAM and Public Administration from UiTM. His business

occupation is advocates and solicitors. He was appointed as an Independent

Non-Executive Director of Supermax Corporation Berhad on 18 July 2002. He

currently chairs the Remuneration Committee and is a member of the Audit

Additional Information On The Board Of Directors

famiLy reLationShipS With any direCtor and / or maJor SharehoLder

None of the Directors of the Company has family relationships with any Director and/or major shareholder with the

1. Dato' Seri Stanley Thai and Datin Seri Cheryl Tan are husband and wife; and

2. Dato' Dr. Tan Geok Swee @ Tan Chin Huat is the brother of Datin Seri Cheryl Tan.

ConfLiCt of intereSt

None of the Directors of the Company has any conflict of interest with the Company.

LiSt of ConViCtionS for offenCeS Within paSt 10 yearS other than traffiC offenCeS

None of the Directors of the Company has been convicted for offences within the past ten (10) years other than traffic

offences, if any.

SharehoLdinGS in the Company and itS SuBSidiarieS

Details are set out on page 98 of the Annual Report.

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Executive Chairman's Statement

The glove industry has remained strong and vibrant in 2013 amid a switch in demand momentum towards nitrile gloves.

While nitrile gloves formed merely 25% of Malaysia's rubber glove exports in 2009, the sharp rise in natural rubber latex

prices which began in 2010 has proved to be a catalyst that has driven a shift in demand from natural rubber (NR) gloves

to nitrile gloves. Today, nitrile glove exports from Malaysia form a hefty 47% of Malaysia's total rubber glove exports and

this number continues to grow.

In line with Supermax's market driven philosophy, it intends to ride this momentum with the continued expansion of nitrile

glove production capacity. It began with the quick response measure of converting suitable NR glove production lines to

nitrile glove production lines but which has since extended to the construction of new nitrile designated plants.

We have the Plant # 10 & # 11 of Supermax Group which are now moving towards completion, testing and commissioning

of the new production lines and we have another further mega projects in the pipeline aimed at keeping Supermax at the

forefront of the glove industry.

Despite average selling for gloves falling in tandem with lower raw material prices, the Group had performed creditably

to record an improved performance on a whole year basis, breaching over the RM1 billion mark for revenue. And with the

new capacity coming on-stream this year following the commissioning of the new production lines at the 2 new plants,

the Group is poised to make greater inroads into the nitrile segment and gaining more market share in particular in the

Acure-Care and Hospitals segment going forward.

GLoVe induStry update

raw material prices

(i) Natural rubber latex

Natural rubber latex prices have generally trended lower this year. From an average of RM6.60 per kg wet in year 2012

to RM5.60 in year 2013, a 15% fall over the course of a year. As often the case, prices started the year on a stronger

note, averaging above RM6.15 in the 1st quarter of 2013 in tandem with the wintering period for rubber trees. But

thereafter, prices gradually retreated before closing the year at an average of RM5.26 in the final quarter of the year.

Prices have since eased further to under RM5.00 per kg wet in Q1 2014.

Natural rubber latex supply has been on the rise as a result of the expansion of rubber planting acreage across

the region. While Thailand and Indonesia have continued to grow their natural rubber production to remain as the

undisputed No 1 and No. 2 rubber producers in the world, Vietnam has come up strongly to become the 3rd largest

producer in the world, overtaking Malaysia in the process.

With increase in production of Natural Rubber Latex, we are anticipating an over- supply of NRL which would result

in continuing depressed of material prices for the rest of year 2014 and beyond.

While the fall in raw material prices was welcome in terms of its impact in lowering the Group's manufacturing costs,

it also had the less welcome impact of lowering average selling prices (ASPs) and ultimately sales revenue. This has

had an impact on the top-line performance of most glove producers but profit margins remain healthy.

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Executive Chairman's Statement (continued)

(ii) Nitrile latex

Nitrile latex material suppliers had aggressively expanded their capacity in 2010 and this has led to somewhat of an

oversupply situation. While this has benefited the glove makers in the form of relatively stable and low cost of raw

material, the proliferation of nitrile glove production capacity among manufacturers have seen more and more take-up

for the nitrile latex material supply.

And with crude oil prices projected to increase going forward as the world economy continues to gradually pick up

speed, nitrile latex material prices may see an uptick during the months and years ahead. We see nitrile latex material

prices inching higher from the current prices of between USD1,000 to US$1,150 per metric ton.

Glove demand

The Malaysian Rubber Gloves Manufacturers Association

(MARGMA) has forecast that global demand for rubber

gloves would rise to 170 billion pieces per annum this

year. Demand growth would be driven by factors such as

rising affluence in developing countries the likes of China

and India along with the African countries and Middle

East countries that are coming up strongly economically,

healthcare regulations being implemented in more and

more countries and also new uses for disposable gloves in

addition to the traditional use in the medical sector.

As mentioned earlier, there is a growing shift in demand

from natural rubber latex gloves to nitrile gloves as the

nitrile gloves have become relatively cheaper in the last few

years. We see the market moving towards a 55:45 nitrile to

NRL glove ratio in the near to medium term before settling

at a 50:50 ratio over the longer term. There is every chance

that NR latex prices will trend lower while nitrile latex prices

may move the other way resulting in NR rubber gloves

regaining its price competitiveness.

Regardless of whichever way market demand pans out

going ahead, Supermax will be well poised with the

demand, drive and flexibility to capture market share

whichever way the market moves as the Company remains

very much market driven and possesses technologically

advanced and flexible production lines that can switch

between NR and nitrile glove production with the minimum

of production fuss.

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Executive Chairman's Statement (continued)

update on Supermax

(i) New National Distribution Headquarters in USA

Towards the end of year 2013, Supermax moved into its brand new premises in Chicago, Illinois. Phase 1, or the East

Building, was completed and it features a 90,170 sq ft warehouse & distribution facility coupled with a 6,000 sq ft

office which now houses Supermax's new National Distribution Headquarters for its US operations.

With Phase 1 completed, the Group is now well on its way to capturing a bigger US market share, with emphasis

on the nitrile glove market. The US is not just the world's largest consumer of Medical gloves, it is also the biggest

market for nitrile gloves. There is a lot of room for Supermax to grow in this segment as it will soon have the additional

capacity which allows Supermax to gain greater market share in the US.

(ii) Completion of Lots 6058 and 6059 plants

The construction of the Group's 10th and 11th plants are scheduled for completion and the first batch of lines

is expected to be commissioned in 3rd quarter, 2014. The remaining lines will be commissioned progressively in

batches. We will see a full-year contribution from the additional annual capacity of 5.4 billion pieces from year 2015

(iii) Supermax Business Park

The Group completed the acquisition of a large 100-acre piece of land in Serendah, Selangor, early this year and the

master plan to develop the Supermax Business Park on this piece of land is being fine-tuned at this moment.

This project will encompass the construction of the Group's Integrated Glove Manufacturing Complex (IGMC)

comprising the construction of high capacity high efficiency production lines complete with the latest generation of

auxiliary machinery featuring automated processes from stripping to stacking to packing; and also construction of

factory lots catered to the supporting industries for rubber glove manufacturing such as the ceramic/porcelain former

makers, chemical and packaging suppliers as well as the engineering and automation companies.

This project will keep us busy and keep us at the forefront of the rubber glove industry for the next 9 to 10 years.

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Executive Chairman's Statement (continued)

The Group has performed creditably to record both top-line and bottom-line growth on the back of increased capacity

gained from refurbishing efforts, process streamlining and also cost savings from declining rubber latex prices. The

Group's automation efforts of the last few years, the new high-tech high efficiency capacity coming on-stream from the

2nd half of this year, robust demand and favourable forex and latex price trends are among the positive factors that are

expected to drive top-line and bottom-line growth for this year.

On the dividend front, similarly to FYE2012, the Company has paid out an interim 4% tax exempt dividend for FYE2013

and the Board has proposed a final 6% tax exempt dividend which is subject to shareholders' approval at the upcoming

Annual General Meeting. This is largely in line with our aim to pay out 30% of Profit after Tax (increased from 20% prior to

FY2012) in order to further reward our loyal and supportive shareholders.

Our immediate focus is to expedite the completion of Plants #10 and #11 after which the increased nitrile glove capacity

would enable the Group to make greater inroads into the US market and other countries where the demand is increasingly

I would also like to thank all my staff from all levels for their commitment and efforts towards the achievement of all of the

Group's objectives. My thanks also go out to all our business associates for their continuous support.

Last but certainly not least, I would like to thank all the Shareholders for their support and belief in Supermax. With the

support and contributions from the Board and all my staff, it will be my commitment to take Supermax to ever greater

dato' Seri Stanley thai

Founder, Executive Chairman and Group Managing Director

April 30th, 2014

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

BiomaSS aS an aLternatiVe enVironmentaLLy friendLy fueL SourCe

The Supermax Group has a "Protect your Health, Protect the Environment" philosophy the daily practice of which is

encouraged and instilled among all levels of its organisation. Among its major ongoing initiatives which emphasises

environmental preservation is the use of an alternative fuel source which is renewable and sustainable to fire its heating

systems and for power generation.

With this in mind, the Group has implemented biomass systems at some of its factories. The fuel used is basically the

waste from the oil palm industry such as palm kernel shells and empty fruit bunch and from the wood-based industry

(such as wood waste from the furniture industry and even the tree trimmings from pruning work done by the local

councils). The need for depleting and non-renewable energy sources is therefore greatly reduced. The Group has spent

close to RM20 million over the years to build up and upgrade its biomass facilities.

The Group has spent close to RM20.0 million over the years to build up, upgrade and maintain its biomass facilities.

A further RM5 million has been earmarked to build a new large scale biomass facility in Bukit Kapar for its ‘Glove City'

Project which will entail the setting up of 6 large factories over the next 10 – 12 years commencing from the first half of

WaSte Water manaGement

Another ongoing ‘green' project undertaken by the Supermax Group is the treatment of wastewater. Wastewater from the

Supermax Group's manufacturing facilities is treated on site in effluent treatment plants utilising a chemical flocculation,

anaerobic digestion and activated sludge process. The Group collaborates closely with the Department of Environment

to conduct regular checks to ensure that the final discharge is clean and safe. The Supermax Group spares no expense

or effort to ensure that all of its manufacturing facilities do not pollute the environment nor endanger the health of its

employees or the communities residing within the vicinity. The Group has spent over RM7 million on this project.

BeSt praCtiCeS in the WorKpLaCe

Supermax places great emphasis on health and safety and making the Supermax workplace a conducive working

environment for its entire workforce. It currently holds the ISO 9001:2008 certification and other quality management

system certifications which showcase its commitment to providing stakeholders an assurance of quality in fulfilling

requirements whilst optimizing environmental performance.

Training and re-training of staff are conducted on a regular

basis. Its policies are also non-bias in nature, be they in

terms of gender, ethnicity, etc.

Ongoing initiatives include

- strict "No child labour" policy

- equal employment opportunity in terms of gender

and ethnicity across all levels of employment from the

boardroom to the factory floor

- encouraging a healthy lifestyle and building camaraderie

among staff by providing support for social and sporting

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Corporate Social Responsibility (continued)

We have also recently completed the setting up of our new distribution headquarters in Chicago, Illinois. This 90,200 sq ft.

state-of-the-art warehouse and office facility in Aurora was designed and built with environment conservation in mind and

has received the LEED (Leadership in Energy & Environmental Design) Gold Certification recognized by the U.S. Green

Building Council. The facility has many environmentally-friendly features such as photovoltaic solar panels and other

energy saving fixtures such as full LED lighting to increase efficiency.

BeSt praCtiCeS in the marKetpLaCe

Supermax also recognises the importance of practising the highest standards of corporate governance throughout the

Group as a fundamental part of discharging its responsibilities to protect and enhance stakeholders' value and has taken

all reasonable steps to ensure that the best practices are adopted and implemented wherever possible.

Supermax has ensured that all of Bursa Malaysia's listing requirements are duly complied with such as timely reporting

of quarterly results and other announcements. Supermax also regularly engages with stakeholders including analysts,

fund managers, investors and other shareholders wherever possible via various means and platforms from investor

conferences and road shows to over the phone providing comprehensive updates.

BeSt praCtiCeS in the Community

Supermax believes in giving back to the community and have over the years donated generously in times of need.

They include the donation of gloves during the devastating Katrina and Indian Ocean Tsunami natural disasters, also

on a smaller scale albeit more regular basis to dialysis

centre and St John Ambulance as well as donations in

cash and kind to various places of worship and animal

We also believe in helping our youths achieve their

academic dreams and have, in collaboration with

the Malaysian Rubber Export Promotion Council

(MREPC) provided scholarships to needy students

over the past 3 years.

The Supermax Foundation has also been set up to

formalize and facilitate the Group's CSR efforts,

especially in sponsoring students from lower income

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Audit Committee Report

MeMbers of Audit CoMMittee

Mr Gong Wooi teik, felix

Chairman of Committee, Independent Non-Executive Director

encik rashid bin bakar

Member of Committee, Independent Non-Executive Director

encik shamsudin @ samad bin Kassim

Member of Committee, Independent Non-Executive Director

terMs of referenCe of Audit CoMMittee

The Board constitutes and establishes an audit committee with authority, responsibilities and specific duties as described

(1) The Audit Committee must be composed of no fewer than 3 non-executive directors, with a majority of them being

independent directors;

(2) All the Audit Committee members must be financially literate, with at least one member:-

(i) must be a member of the Malaysian Institute of Accountants; or

(ii) if he is not a member of the Malaysian Institute of Accountants, he must have at least 3 years' working experience

(a) he must have passed the examinations specified in Part I of the 1st Schedule of the Accountants Act 1967; or

(b) he must be a member of one of the associations of accountants specified in Part II of the 1st Schedule of the

Accountants Act 1967; or

(iii) fulfils such other requirements as prescribed or approved by the Exchange;

(3) No alternate director shall be appointed as a member of the Audit Committee; and

(4) The members of the Audit Committee shall elect a Chairman from among themselves who shall be an Independent

Director. The Chairman of the Audit Committee should engage on a continuous basis with senior management, the

head of internal audit and the external auditors in order to be kept informed of matters affecting the company.

(5) All members of the Audit Committee, including the Chairman, will hold office only so long as they serve as Directors

of the Company. The Board must review the term of office and performance of the Audit Committee and each of

its members at least once every 3 years to determine whether the Audit Committee has carried out its duties in

accordance with its terms of reference.

duties And responsibilities of the Audit CoMMittee

The Audit Committee shall review and report the same to the Board on the following key matters:-

(i) To review the appointment, resignation, conduct and audit plans of the Internal and External Auditors;

(ii) To review the assistance given by the employees of the Company to the external auditors and the internal auditors;

(iii) To review the quarterly results and year end financial statements, prior to the approval by the Board;

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Audit Committee Report (continued)

(iv) To review any related party transaction and conflict of interest situations that may arise within the Company or Group

including any transaction, procedure or course of conduct that raises questions of management integrity; and

(v) To oversee the Company's internal control structure to ensure operational effectiveness and efficiency, reduce risk

of inaccurate financial reporting, protect the Company's assets from misappropriation and encourage legal and

riGhts And Authority of the Audit CoMMittee

In carrying out its duties and responsibilities, the Audit Committee will:-

(1) have the authority to investigate any matter within its terms of reference;

(2) have the resources which are required to perform its duties;

(3) have full and unrestricted access to any information pertaining to the Company;

(4) have direct communication channels with the external auditors and person(s) carrying out the internal audit function

(5) be able to obtain independent professional or other advice and to invite outsiders with relevant experience and

expertise to attend the Audit Committee meetings (if required) and to brief the Audit Committee; and

(6) be able to convene meetings with the external auditors, the internal auditors or both, excluding the attendance of

other directors and employees of the Company, whenever deemed necessary.

AttendAnCe of MeetinGs

Five (5) meetings were held during the financial year. The records of attendance are as follows: -

no. of Meetings Attended

Gong Wooi Teik, Felix

Shamsudin @ Samad Bin Kassim

suMMAry of ACtivities

The Audit Committee has discharged its duties as set out in its Terms of Reference. During the financial year, the activities

undertaken by the Audit Committee included the following :

1. Reviewed and recommended the quarterly financial results for Board approval;

2. Reviewed and recommended the audited financial statements for Board approval;

3. Considered the matters relating to corporate governance in compliance with the revamped Listing Requirement of

Bursa Malaysia Securities Berhad and the Malaysian Code on Corporate Governance;

4. Review and deliberation of significant risk areas, internal control and financial matters coming to the attention of the

external auditors in the course of their work.

internAl Audit funCtion

The Board considers the audit function to be an integral and important part of the governance process. The Internal Audit

Department carried out the internal audit function for Supermax Group during the financial year under review. The internal

auditors conduct reviews on systems of controls and the effectiveness of the processes which management has in place

to identify, manage and control proper conduct of business within the Group.

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Corporate Governance Statement

The Board of Directors recognises the importance of practicing the highest standards of Corporate Governance throughout

the Group as a fundamental part of discharging its responsibilities to protect and enhance shareholders' value and the

financial performance of Supermax Corporation Berhad.

With this in mind, measures and efforts have and shall be taken to ensure as far as practicable the adoption and

implementation of the Principles and Best Practices set out in the Malaysian Code on Corporate Governance ("the Code")

and in the Main Market Listing Requirement ("MMLR") of the Bursa Malaysia Securities Berhad ("Bursa Securities").

Set out below is a description of how the Group has applied the Principles of the Code and how the Board of Directors

has complied with the Best Practices set out in the Code throughout the financial year ended 31 December 2013.

seCtion A – the boArd of direCtors

size And CoMposition of the boArd

An experienced and effective Board consisting of members with a wide range of skills and experience from financial and

business backgrounds leads and controls the Group. The Directors bring depth and diverse expertise to the leadership of

the challenging and highly competitive glove business.

The Board continues to give close consideration to its size, composition and spread of experience and expertise. No

individual or group of individuals dominates the Board's decision making and the number of Directors reflects fairly the

investment of the shareholders. This is to ensure that issues of strategy, performance and resources are fully discussed

and examined to take into account long-term interest of stakeholders of the Company.

The Company continues to be led by the same board members with professional and business experience.

The Board comprises the Executive Chairman and Group Managing Director, one Executive Director and five Non-

Executive Directors, four of whom are Independent Directors.

The Board has also identified Dato' Ting Heng Peng as the senior independent non-executive director to whom concerns

if any may be conveyed.

The appointment of Datin Seri Tan Bee Geok, Cheryl in the year 2000 reflects that the Board recognises the value of a

woman member of the Board and was an initial step taken by the Board towards achieving a more gender diversified

The profile of each of the Member of the Board is as presented on pages 7 to 11 of this annual report.

duties And responsibilities of the boArd

The responsibilities of the Board of Directors of the Company are as follows:-

• Reviewing and adopting a strategic plan for the Company which will enhance the future growth of the Company;

• Overseeing the conduct of the Company's business to evaluate whether the business is being properly managed;

• Identifying principal risks of the business and ensure the implementation of appropriate systems to manage these

• Reviewing the adequacy and the integrity of the Company's internal control systems and management information

systems, including systems for compliance with applicable laws, regulations, rules, directives and guidelines.

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Corporate Governance Statement (continued)

boArd bAlAnCe And independenCe of direCtors

The Board members have a wealth of experience as well as skills and knowledge, which are relevant to the Group.

Although the Chairman is jointly responsible for the Group's strategic business direction, the roles of the Chairman and

Group Managing Director are separate with clearly defined responsibilities to ensure the balance of power and authority.

The Chairman is primarily responsible for the orderly conduct and working of the Board whilst the Group Managing

Director is responsible for the overall operation of the business and the implementation of Board strategy and policy.

All the Independent Non-Executive Directors are independent of Management and are free from any business or other

relationship that could materially interfere with the exercise of their independent judgment. They have the calibre to

ensure that the strategies proposed by the Management are fully deliberated and examined in the long-term interest of

the Group, as well as shareholders, employees and customers.

The Nomination Committee and the Board have upon their annual assessment, concluded that each of the 4 Independent

Non-Executive Directors continues to demonstrate conduct and behaviour that are essential indicators of independence,

and that each of them continues to fulfill the definition of independence as set out in the Bursa Malaysia Main Market

One of the recommendations of the Malaysian Code of Corporate Governance (MCCG) 2012 states that the tenure of an

independent director should not exceed a cumulative term of 9 years. However the Nomination Committee and Board

have determined at the annual assessment carried out that Dato' Ting Heng Peng, Gong Wooi Teik, Felix, Shamsudin @

Samad bin Kassim, and Rashid bin Bakar, remain objective and independent in expressing their views and in participating

in deliberations and decision making of the Board and Board Committees. The length of their service on the Board does

not in any way interfere with their exercise of independent judgement and ability to act in the best interest of Supermax

Corporation Berhad.

The Committee also finds that each of the directors possess and continue to gain and develop the necessary experience

and core competencies to discharge their duties as directors individually, as a Board and within the relevant sub-

committees in which they serve. They have also exhibited the ability to devote sufficient time to carry out their duties and

responsibilities and to further their knowledge and skills required.

direCtors' Code of ethiCs

The Directors observe a code of ethics in accordance with the code of conduct expected of Directors in the Company

Directors' Code of Ethics established by the Companies Commission of Malaysia.

boArd MeetinGs And supply of inforMAtion to the boArd

During the financial year under review, five (5) board meetings were held. Details of the Directors' attendance at these

meetings are as follows:-

total no. of Meetings

Dato' Seri Thai Kim Sim

Datin Seri Tan Bee Geok

Dato' Dr. Tan Geok Swee @ Tan Chin Huat

Dato' Ting Heng Peng

Gong Wooi Teik, Felix

Shamsudin @ Samad bin Kassim

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Corporate Governance Statement (continued)

The Group Managing Director of the Company undertakes the responsibility to ensure that the agenda and full set of Board

papers (including qualitative information of the Company) for consideration are distributed well before each meeting of

the Board to ensure that the Directors have sufficient time to study them and be properly prepared for discussion and

decision making. Minutes of Board meetings are maintained.

All Directors of the Company whether in full Board or in their individual capacity, have access to all information within the

Company and to seek independent professional advice where necessary and in appropriate circumstances, in furtherance

of their duties.

The Directors also have access to the advice and services of the Company Secretary who is responsible for ensuring the

Board meeting procedures are followed and that applicable rules and regulations are complied with.

neW AppointMent And re-eleCtion of direCtors

The Nomination Committee established by the Board is responsible for assessing the nominee(s) for directorship and

Board Committee membership and thereupon submitting their recommendation to the Board for decisions.

The selection process involves the assessment of essential skill sets including relevant industry experience and experience

in developing corporate growth strategies, knowledge on legal and regulatory requirements, ability to read, analyse and

interpret financial statements and also working knowledge and experience in business development.

Each Director must retire from office at least once in every three years and can offer himself/herself for re-election.

Directors who are appointed by the Board are subject to election by the shareholders at the next Annual General Meeting

("AGM") held following their appointment.

The Nomination Committee consists of the following:-

: Dato' Ting Heng Peng

(Independent

Non-Executive

: Dato' Dr. Tan Geok Swee @ Tan Chin Huat

(Non-Executive

Encik Shamsudin @ Samad Bin Kassim

(Independent

Non–Executive

The duties and responsibilities of the Nomination Committee are as follows: -

a) To recommend to the Board of Directors, candidates for directorships to be filled by the Shareholders or the Board of

b) To consider, in making its recommendations, candidates for directorships proposed by the Group Managing Director

and, within the bounds of practicability, by any other senior executive or any Director or Shareholder;

c) To recommend to the Board, Directors to fill the seats on the Board committees;

d) To assist the Board to annually review its required mix of skills and experience and other qualities, including core

competencies, which Non-Executive Directors should bring to the Board;

e) To assess the effectiveness of the Board of Directors as a whole and each individual Director/Committee of the Board;

f) To consider and examine such other matters as the Nomination Committee considers as appropriate.

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Corporate Governance Statement (continued)

All the Directors of the Company have attended the Mandatory Accredition Programme (MAP) prescribed by Bursa

Securities for directors of public listed companies. The Directors will also attend trainings to keep abreast with developments

in relation to the capital markets, relevant changes in laws and regulations and/or the business environment from time to

In 2013, the Directors attended the following seminars and briefings conducted by the regulatory authorities and members

of professional bodies, in order to stay abreast with the latest developments in the industry and to better enable them to

fulfill their responsibilities:-

Encik Shamsudin @ Samad Bin Kassim attended the following programs:

1) The Development in ASEAN Automotive Industry: Opportunities & Challenges – presented by Rt. Hon. Dr. Surin

Pitsuwan at Ingress Corporation Bhd's Directors & Senior Management Seminar held in Bangkok, Thailand

2) Sustainability Training for Directors and Practitioners; by Bursa Malaysia

3) Nominating Committee Programme; by ICLIF and Bursa Malaysia

4) On-going Business Improvement; by Finet Associates Sdn Bhd

5) Audit Committee And Chief Audit Executive Forum: Enhancing Internal Audit's Value; by Institute of Internal Audit

Mr Gong Wooi Teik, Felix attended the following programs:

1) Asean Audit Regulators Inspection Forum by Securities Commission

2) Advocacy Sessions on Corporate Disclosure for Directors of Listed Issuers; by Bursa Malaysia

3) National Tax Conference 2013; by Chartered Tax Institute of Malaysia

4) Budget Seminar 2013; by Inland Revenue Board Malaysia

Dato' Ting Heng Peng attended the following programs:

1) Portfolio Management Strategies; by CHK Consultancy Sdn Bhd

2) Risk Management and Internal Control Workshop for Audit Committee Members; by Bursa Malaysia

seCtion b – direCtors' reMunerAtion

The Remuneration Committee consists of the following:-

: Encik Rashid Bin Bakar

(Independent

Non-Executive

: Dato' Ting Heng Peng

(Independent

Non-Executive

Datin Seri Tan Bee Geok, Cheryl

(Executive

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Corporate Governance Statement (continued)

The duties and responsibilities of the Remuneration Committee are as follows:-

a) To review and assess the remuneration packages of the Executive Directors in all forms, with or without other

independent professional advice or other outside advice;

b) To ensure the levels of remuneration be sufficiently attractive and be able to retain Directors needed to run the

Company successfully;

c) To structure the component parts of remuneration so as to link rewards to corporate and individual performance and

to assess the needs of the Company for talent at Board level at a particular time; and

d) To consider and examine such other matters as the Remuneration Committee considers appropriate.

The remuneration of the non-executive directors is determined in accordance with their experience and level of

responsibilities assumed. Non-executive directors are remunerated in the form of directors' fees as approved by the

The aggregate Directors' remuneration paid or payable or otherwise made available to all Directors of the company during

the financial year are as follows:

salaries & other emoluments

Benefit in kind

Executive Directors

Non-executive Directors

The number of Directors of the Company whose income from the Company falling within the following bands are:

RM 1,000,000 and above

RM 50,001 – RM100,000

seCtion C: shAreholders

diAloGue With investors And shAreholders

The Annual General Meeting (AGM) is the principal forum for dialogue with shareholders. At each AGM, the Board

presents the progress and performance of the business and shareholders are encouraged to participate in the questions

and answers session.

seCtion d – ACCountAbility And Audit

direCtors' responsibility stAteMents

The Directors are required by the Companies Act, 1965 to prepare financial statements for each financial year which give

a true and fair view of the state of affairs of the Company and the Group as at the end of the financial year.

The Directors consider that in preparing the financial statements, the Group has used appropriate accounting policies,

consistently applied and supported by reasonable and prudent judgements and estimates, and that all applicable

accounting standards have been followed.

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Corporate Governance Statement (continued)

The Directors have responsibility for ensuring that the Company and the Group keep accounting records which disclose

with reasonable accuracy the financial position of the Company and the Group and which enable them to ensure that the

financial statements comply with the Companies Act, 1965.

The Directors have general responsibility for taking such steps as are reasonably open to them to safeguard the assets of

the Company and the Group and to prevent and detect fraud and other irregularities.

The Directors are responsible for the preparation of the annual audited financial statements and ensure that the accounts

and other financial reports of the Company are prepared in accordance with Approved Accounting Standards and present

a balanced and comprehensive assessment of the Company's position and prospects, to all the shareholders.

The Company's Annual Report and quarterly announcements of results give an updated financial performance of the

The Audit Committee comprises three Independent Non-Executive Directors with Mr Gong Wooi Teik, Felix as the

Chairman of the Committee. The composition and Terms of Reference of the Audit Committee are also provided in this

The Audit Committee has explicit authority from the Board to investigate any matter and is given full responsibility within its

Terms of Reference and necessary resources which it need to do so and full access to information. The Audit Committee

also meets twice a year with the External Auditors without the presence of the Executive Board members.

The Statement of Risk Management and Internal Control furnished on page 27 to 28 of the annual report provides an

overview of the internal controls within the Group.

The Company set up its Internal Audit Department on 8 December 2003. Internal auditors adopt a risk – based approach

in the planning and conduct of its audits and focuses on the key areas of business risk.

The main responsibilities of the Internal Auditors are to:-

a) Assist in reviewing the adequacy, integrity and effectiveness of the Company's internal control system for the Board

to make an accurate Statement on Internal Control in the annual report;

b) Support the Audit Committee in evaluating the effectives of the existing internal control system, identify future

requirements and co-develop a prioritised action plan to further enhance the internal control system; and

c) Perform a risk assessment of the Company to identify the business processes within the Company that internal audit

should focus on.

relAtionship With externAl Auditors

The Board ensures that there is transparent arrangement for the achievement of objectives and maintenance of professional

relationship with External Auditors.

other inforMAtion reQuired by the MMlr of bursA seCurities

During the financial year ended 31 December 2013, the Company carried out one (1) share buy-back transaction which

amounted to 1,000 ordinary shares of RM0.50 each purchased from the open market. The 1,000 ordinary shares were

acquired for a total consideration of RM2,363.70 on 29 August 2013 at a purchase price of RM2.32 per share.

As at 31 December 2013, the Company has 1,003,000 ordinary shares of RM0.50 each which are listed and quoted on

the Main Market of Bursa Securities, retained as treasury shares.

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Corporate Governance Statement (continued)

depository reCeipt ("dr") proGrAMMe

During the financial year, the Company was involved in a Sponsored Level-1 American Depositary Receipt ("ADR")

Program, which is a program to facilitate the trading of Supermax's shares by investors in the United States of America

("the US"), has been declared effective by the Securities and Exchange Commission of the US on 20 December 2010.

The Bank of New York Mellon has been appointed as the depository bank for the ADR Program with Malayan Banking

Berhad as the custodian of Supermax's shares in Malaysia for the ADR. The total number of shares that can be purchased

under the ADR shall not exceed 5% of the total issued and paid-up capital of Supermax at any point in time. As at 15

March 2014, the total number of Supermax shares issued was 680,154,880.

As at 31 December 2013, there are no depository receipts issued against the Company's issued and paid-up capital.

The ADR program is anticipated to enhance the visibility of the Company in the US, as well as, to increase the awareness

on the Company among US brokers, analysts and investors as the ADR program provides an avenue for US investors

to access to Supermax's shares, thereby allowing the Company to broaden its' foreign shareholders base in addition to

increasing its' shareholders diversity.

iMposition of sAnCtions / penAlties

There were no sanctions and/ or penalties imposed on the Company or its subsidiaries, Directors or management by the

relevant regulatory bodies during the financial year.

There is no non-audit fee paid by the Company to the External Auditors for the financial year.

vAriAtion in results for profit estiMAte, foreCAst or projeCtion

The Company did not make any release on the profit estimate, forecast or projections for the financial year. The variance

between the audited results (net profit after taxation) and the unaudited results announced to Bursa Securities is less than

During the year, there were no profit guarantees given by the Company.

During the year under review, the Company and its subsidiaries did not enter into any material contracts involving Directors'

and major shareholders' interest.

ContrACt relAtinG to loAns

There were no contracts relating to loans entered into by the Company involving Directors' and major shareholders' interest.

relAted pArty trAnsACtions

A list of the significant related party transactions between the Company and its subsidiaries, and between the Group and

other related parties including relevant Key Management personnel for the financial year ended 31 December 2013 is set out

on pages 80 to 81 of the Annual Report.

revAluAtion of lAnded properties

The Company does not have a revaluation policy on landed properties.

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Statement On Risk Management And Internal Control

The Malaysian Code on Corporate Governance requires listed companies to maintain a sound system of risk management

and internal control to safeguard the shareholders' investments and the companies' assets.

The Board of Directors of Supermax Corporaton Bhd is committed to maintain a sound system of risk management and

internal control within the Group. Set out below is the Board of Directors' "Statement on Risk Management and Internal

Control" which has been prepared in accordance with the Guidance for Directors of Public Listed Companies on the

Statement on Risk Management and Internal Control.

responsibility of the boArd

The Board of Directors ("Board") is responsible for the adequacy and effectiveness of the Supermax Group's ("the Group")

risk management and internal control system. The Board ensures that the system manages the Group's key areas of risk

within an acceptable risk profile to increase the likelihood that the Group's policies and business objectives will be achieved.

The Board continually reviews the system to ensure it provides a reasonable but not absolute assurance against material

misstatement of management and financial information and records or against financial losses or fraud.

The Board has established an ongoing process for identifying, evaluating and managing the significant risks faced by the

Group and this process includes enhancing the risk management and internal control system as and when there are changes

to the business environment or regulatory guidelines.

Management assists the Board in the implementation of the Board's policies and procedures on risk and control by

identifying and assessing the risks faced, and in the design, operation and monitoring of suitable internal controls to mitigate

and control these risks.

The Board has received assurance from the Chief Executive Officer and the Chief Financial Officer that the Group's risk

management and internal control system is operating adequately and effectively, in all material aspects, based on the risk

management and internal control system of the Group.

The Board is of the view that the risk management and internal control system in place for the year under review and up to

the date of issuance of the financial statements is adequate and effective to safeguard the shareholders' investment, the

interests of customers, regulators and employees, and the Group's assets.

risK MAnAGeMent frAMeWorK

The Board of Directors is aware that a sound system of internal control should be embedded in the operations of the

Group and form part of its culture. This system should be capable of responding quickly to evolving risks to the business

arising from factors within the Group and changes in the business environment. It should include procedures for reporting

immediately to appropriate levels of management any significant control failings or weaknesses that are identified together

with details of corrective action being taken.

The Group has in place an on–going process for identifying, monitoring and managing significant risks that may affect the

achievement of business objectives. This is done through our Quality Assurance Department and Operational Internal Audit

Management is continuously reviewing potential risk areas through discussions held at monthly staff meetings. Where a

particular risk is identified, it will be monitored with counter measures taken to mitigate the risk wherever possible.

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Statement On Risk Management And Internal Control (continued)

other Key eleMents of risK MAnAGeMent And internAl Control

Apart from the above, the other key elements of the Group's internal control systems are as follows: -

a) Clearly documented internal policies and procedures including those that are ISO 9001:2008, ISO 13485:2003 and ISO

13485:CMDCAS compliant are in place and regularly updated to reflect changing risk or resolve operational deficiencies.

b) Regular and comprehensive information provided to Management for monitoring of performance against strategic plan,

covering all key financial and operational indicators.

c) On quarterly basis, Managing Director reviews with the Board on all issues covering strategy and performance of the

The overall system of internal control was satisfactory and has not resulted in any material losses, contingencies or

uncertainties that would require public disclosure.

internAl revieW And Audit

The in–house Internal Audit Department was established in 2003. The Internal Auditors review the internal controls on the

key activities of the Group on the basis of a detailed annual internal audit plan. The internal audit functions are carried out

to minimise the Company's exposure to risk and problems. The Internal Auditors will continue to come up with proactive

measures or corrective actions to manage and mitigate potential business and operational risks noted in the course of

carrying out their duties. In the event of any unavoidable cases, the Internal Auditors will do a thorough review and resolve

the issues immediately.

revieW of the stAteMent by externAl Auditors

The external auditors have reviewed this Statement on Risk Management and Internal Control for inclusion in the annual

report of the Company for the year ended 31 December 2013 and reported to the Board that nothing has come to their

attention that causes them to believe that the statement is inconsistent with their understanding of the process adopted by

the Board in reviewing the adequacy and effectiveness of the risk management and internal control system.

Director's Report

Consolidated Statement of Financial Position

Statements of Comprehensive Income

Statements of Changes In Equity

Statements of Cash Flow

Notes to the Financial Statements

Supplementary Information on the Disclosure of

Realised and Unrealised Profits or Losses

Statement by Directors

Statutory Declaration

Independent Auditors' Report

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

The directors hereby submit their report together with the audited financial statements of the Group and of the Company

for the financial year ended 31st December 2013.

The Company is principally engaged in investment holding whilst the principal activities of the subsidiaries are as stated

in Note 6 to the financial statements. There have been no significant changes to the nature of these principal activities

during the financial year.

Net profit for the financial year

118,990,407 14,308,150

Attributable to:-

Owners of the parent

119,715,972 14,308,150

Non-controlling interest

118,990,407 14,308,150

Dividends paid by the Company since the end of the previous financial year were as follows:-

In respect of the financial year ended 31st December 2012:-

Interim dividend of 4% per ordinary share of RM0.50, tax exempt, paid on 18th January 2013

Final dividend of 6% per ordinary share of RM0.50, tax exempt, paid on 18th June 2013

In respect of the financial year ended 31st December 2013:-

Interim dividend of 4% per ordinary share of RM0.50, tax exempt, paid on 21st January 2014

The directors proposed a single tier final dividend of 6% per ordinary share of RM0.50 amounting to RM20,374,556/- in

respect of the current financial year. The proposed dividend is subject to approval by the shareholders at the forthcoming

Annual General Meeting and has not been included as a liability in the financial statements.

reserves And provisions

There were no material transfers to or from reserves or provisions during the financial year other than those disclosed in

the financial statements.

bAd And doubtful debts

Before the statements of comprehensive income and statements of financial position of the Group and of the Company

were made out, the directors took reasonable steps to ascertain that action had been taken in relation to the writing off

of bad debts and the making of allowance for doubtful debts, and had satisfied themselves that all known bad debts had

been written off and adequate allowance had been made for doubtful debts.

At the date of this report, the directors are not aware of any circumstances that would render the amount written off for

bad debts or the amount of the allowance for doubtful debts in the financial statements of the Group and of the Company

inadequate to any substantial extent.

Before the statements of comprehensive income and statements of financial position of the Group and of the Company

were made out, the directors took reasonable steps to ensure that any current assets, other than debts, which were

unlikely to be realised in the ordinary course of business, their values as shown in the accounting records of the Group

and of the Company had been written down to an amount that they might be expected to be realised.

At the date of this report, the directors are not aware of any circumstances that would render the values attributed to the

current assets in the financial statements of the Group and of the Company misleading.

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Directors' Report (continued)

At the date of this report, the directors are not aware of any circumstances have arisen which render adherence to the

existing methods of valuation of assets or liabilities of the Group and of the Company misleading or inappropriate.

ContinGent And other liAbilities

At the date of this report, there does not exist:-

(i) any charge on the assets of the Group and of the Company that has arisen since the end of the financial year which

secures the liabilities of any other person, or

(ii) any contingent liabilities in respect of the Group and of the Company that has arisen since the end of the financial year.

In the opinion of the directors, no contingent liabilities or other liabilities of the Group and of the Company have become

enforceable, or is likely to become enforceable within the period of twelve months after the end of the financial year which,

will or may substantially affect the ability of the Group and of the Company to meet their obligations as and when they fall

due, other than as disclosed in Note 30 to the financial statements.

ChAnGe of CirCuMstAnCes

At the date of this report, the directors are not aware of any circumstances, not otherwise dealt with in this report or the

financial statements of the Group and of the Company that would render any amount stated in the financial statements

iteMs of An unusuAl nAture

The results of the operations of the Group and of the Company for the financial year were not, in the opinion of the

directors, substantially affected by any item, transaction or event of a material and unusual nature.

There has not arisen in the interval between the end of the financial year and the date of this report, any item, transaction

or event of a material and unusual nature likely, in the opinion of the directors, to affect substantially the results of the

operations of the Group and of the Company for the financial year in which this report is made.

issue of shAres And debentures

During the financial year, the Company did not issue any shares or debentures.

Treasury shares relate to ordinary shares of the Company that are held by the Company. The amount consists solely of

the acquisition costs of treasury shares.

The Company acquired 1,000 shares in the Company through purchases on the Bursa Malaysia Securities Berhad during

the financial year. The total amount paid to acquire the shares was RM2,364/- and this was presented as a component

within shareholders' equity.

The directors of the Company are committed to enhancing the value of the Company for its shareholders and believe

that the repurchase plan can be applied in the best interests of the Company and its shareholders. The repurchase

transactions were financed by internally generated funds. The shares repurchased are being held as treasury shares.

Details of the significant events are disclosed in Note 37 to the financial statements.

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Directors' Report (continued)

The directors in office since the date of the last report are:-

Dato' Seri Thai Kim Sim

Datin Seri Tan Bee Geok

Dato' Ting Heng Peng

Dato' Dr. Tan Geok Swee @ Tan Chin Huat

Shamsudin @ Samad Bin Kassim

According to the Register of Directors' Shareholdings kept by the Company under Section 134 of the Companies Act,

1965 in Malaysia, the interests of those directors who held office at the end of the financial year in shares and options in

the Company during the financial year ended 31st December 2013 are as follows:-

Number of ordinary shares of RM0.50 each

Allotted/

1.1.2013

Dato' Seri Thai Kim Sim

Datin Seri Tan Bee Geok

Dato' Dr. Tan Geok Swee @ Tan Chin Huat

Dato' Ting Heng Peng

Shamsudin @ Samad Bin Kassim

Rashid Bin Bakar

Dato' Seri Thai Kim Sim*

Datin Seri Tan Bee Geok*

* These are their spouse's interest in the ordinary shares of the Company which shall be treated as their interest in the

ordinary shares of the Company pursuant to Section 134(12)(c) of the Companies Act, 1965 in Malaysia.

By virtue of their interests in shares of the Company, Dato' Seri Thai Kim Sim and Datin Seri Tan Bee Geok are deemed

to have an interest in shares of all the subsidiary companies to the extent the Company has an interest in the subsidiary

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Directors' Report (continued)

Since the end of the previous financial year, no director of the Company has received or become entitled to receive

a benefit (other than benefit included in the aggregate amount of emoluments received or due and receivable by the

directors shown in the financial statements) by reason of a contract made by the Company or a related corporation with

the director or with a firm of which the director is a member, or with a company in which the director has a substantial

financial interest.

Neither during nor at the end of the financial year was the Company a party to any arrangement whose object was to

enable the directors to acquire benefits by means of the acquisition of shares in, or debentures of, the Company or any

other body corporate.

The auditors, Messrs Baker Tilly Monteiro Heng, have expressed their willingness to continue in office.

On behalf of the Board,

dAto' seri thAi KiM siM

dAtin seri tAn bee GeoK

Date: 28th April 2014

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Consolidated Statement Of Financial Position

as at 31st December 2013

Property, plant and equipment

522,315,419 446,847,853

Investment property

Prepaid land lease payments

Investment in subsidiaries

- 183,894,064 183,894,064

Investment in associates

214,904,230 209,874,119 18,994,696 19,829,489

Goodwill on consolidation

28,715,854 28,715,854

Deferred tax assets

total non-current assets

773,092,146 690,462,782 202,888,760 203,723,553

10 192,660,713 233,786,632

Trade receivables

11 129,167,383 100,822,162

Other receivables

Other current assets

Amount owing by subsidiaries

- 256,822,067 291,557,693

Amount owing by associates

92,975,862 101,078,141

Cash and bank balances

15 167,129,834 122,863,481

total current assets

596,642,376 563,616,568 258,021,413 292,752,333

totAl Assets

1,369,734,522 1,254,079,350 460,910,173 496,475,886

eQuity And liAbilities

Equity attributable to owners of the parent

16 340,077,440 340,077,440 340,077,440 340,077,440

18 558,572,207 493,954,115 14,556,569 47,791,465

898,649,647 834,031,555 354,634,009 387,868,905

Non-controlling interest

totAl eQuity

897,648,487 833,780,118 354,634,009 387,868,905

Loans and borrowings

19 127,021,956 115,187,503 55,709,000 79,505,900

Deferred tax liabilities

24,200,749 19,993,037

Total non-current liabilities

151,222,705 135,180,540 55,709,000 79,505,900

59,372,922 76,930,128

41,626,755 40,993,394

Amount owing to a subsidiary

Loans and borrowings

19 195,762,576 162,922,784 29,493,000 21,408,100

Dividend payable

Total current liabilities

320,863,330 285,118,692 50,567,164 29,101,081

Total liabilities

472,086,035 420,299,232 106,276,164 108,606,981

totAl eQuity And liAbilities

1,369,734,522 1,254,079,350 460,910,173 496,475,886

The accompanying notes form an integral part of these financial statements.

ANNUAL REPORT 2013

SUPERMAX CORPORATION BERHAD (420405-P)

Statements Of Comprehensive Income

for the financial year ended 31st December 2013

23 1,048,150,699 997,374,339 21,000,000

Other operating income

Changes in inventories in finished

goods and work in progress

(48,949,937) (106,319,855)

(681,104,009) (605,399,316)

Directors' remuneration

24 (13,411,388) (7,132,082)

25 (71,104,764) (54,598,882)

Depreciation and amortisation of property,

plant and equipment

(26,614,669) (24,279,234)

Depreciation of investment property

Amortisation of prepaid lease payments on

Other operating expenses

25 (78,073,416) (85,390,292) (6,259,181) (1,133,146)

(7,632,203) (8,746,244)

Share in profits of associates

16,780,248 23,374,792

Profit before taxation

148,157,017 137,305,588 14,308,150

27 (29,166,610) (15,893,444)

Net profit for the financial year

118,990,407 121,412,144 14,308,150

other comprehensive (loss)/ income,

net of tax:-

Foreign currency translation

(7,578,992) (42,848,080)

(7,578,992) (42,848,080)

total comprehensive income

for the financial year

111,411,415 78,564,064 14,308,150

Profit attributable to:-

Owners of the parent

119,715,972 121,717,800 14,308,150

Non-controlling interest

118,990,407 121,412,144 14,308,150

Total comprehensive income attributable to:-

Owners of the parent

112,161,138 78,867,096 14,308,150

Non-controlling interest

111,411,415 78,564,064 14,308,150

Earnings per ordinary share attributable to

owners of the parent

Basic (sen per share)

Diluted (sen per share)

The accompanying notes form an integral part of these financial statements.

SUPERMAX CORPORATION BERHAD (420405-P)

ANNUAL REPORT 2013

Statements Of Changes In Equity

for the financial year ended 31st December 2013

Total Equity

833,780,118 111,411,415

Total Equity

- - (11,885,189) -

- (47,540,682) -

olling est

(251,437) (749,723)

contr Inter

49,832,669 14,308,150

(93,780,955) (11,885,189)

834,031,555 112,161,138

Retained Pr

retained Pr

522,503,225 121,717,800

538,554,881 119,715,972

- - (93,780,955) - (11,885,189) -

- (47,540,682) -

translation Reserve

- - (42,850,704)